Form 2624 Consent For Third Party Contact

Form 8453, u. s. individual income tax transmittal for an irs e-file return. see form 8453 and its instructions for more details. paperwork reduction act notice. we ask for the information on this form to carry out the internal revenue laws of the united states. you are required to give us the information. we need it to ensure that you are. Taxinformation. each designee is authorized to inspect and/or receive confidential taxinformation for the type of tax, forms, periods, and specific matters you list below. see the line 3 instructions. by checking here, i authorize access to my irs records via an intermediate service provider. (a) type of tax information (income,. (e) as (d) and, in par. (1) of subsec. (d) as so redesignated, substituted a cross reference to section 7216 as covering penalties for disclosure or use of information by preparers of returns for a cross reference to section 6106 as covering special provisions applicable to returns of tax under chapter 23 (relating to federal unemployment tax). presentation sustainability community company company timeline strategy board of directors senior management v endor relations careers operations marcellus north louisiana investor relations press releases company presentation supplemental tables hedging summary sec filings webcast ir contacts email alerts owner relations ownership change owner forms direct deposit faqs owner faqs contact information sustainability environmental stewardship safe & responsible operations community engagement

New Exclusion Of Up To 10200 Of Unemployment

File form 8821 to: authorize any individual, corporation, firm, organization, or partnership you designate to inspect and/or receive your confidential information verbally or in writing for the type of tax and the years or periods listed on the form. delete or revoke prior tax information authorizations. Form ssa-3288 (11-2016) uf destroy prior editions. social security administration. consent for release of information. form approved omb no. 0960-0566. instructions for using this form. complete this form only if you want us to give information or records about you, a minor, or a legally incompetent adult, to an.

Department Of The Treasury Bureau Of The Fiscal Service

Check your state's unemployment compensation website for more information. unemployment compensation exclusion worksheet schedule 1, line 8. if you are filing form 1040 or 1040-sr, enter the total of lines 1 through 7 of form 1040 or 1040-sr. if you are filing form 1040-nr, enter the total of lines 1a, 1b, and lines 2 through 7. Stjoseph's hospital medical records is a business providing services in the field of hospitals. the business is located in tampa, florida, united states. their telephone number is 1 (813) 870-4665. find over 27 million businesses in the united states on the official yellow pages directory website. find trusted, reliable customer reviews on contractors, restaurants, doctors, movers and more. This gives individual taxpayers an additional month to gather the information irs extends a deadline, of irs release form information filers can no longer file an extension. this is not true. taxpayers have the option to file an extension for their personal income tax returns using. Form 14258 (1-2013) catalog number 57875h. publish. no. irs. gov department of the treasury internal revenue service. authorization for disclosure of information. department of health and human services, federal occupational health (foh) services. the use of this form is voluntary.

Third Party Authorization Purpose Internal Revenue Service

This change is reflected on the form 941, employer's quarterly federal tax return. the lines used to report this information have been removed from the 2021 form 941 for the first quarter. Information disclosed to fiscal service by the internal revenue service in order to collect tax debt through the levy process under 26 u. s. c. § of irs release form information 6331(h), and to conduct tax refund offset under 26 u. s. c. §§ 6402. tax return information is defined in 26 u. s. c. § 6103(b).

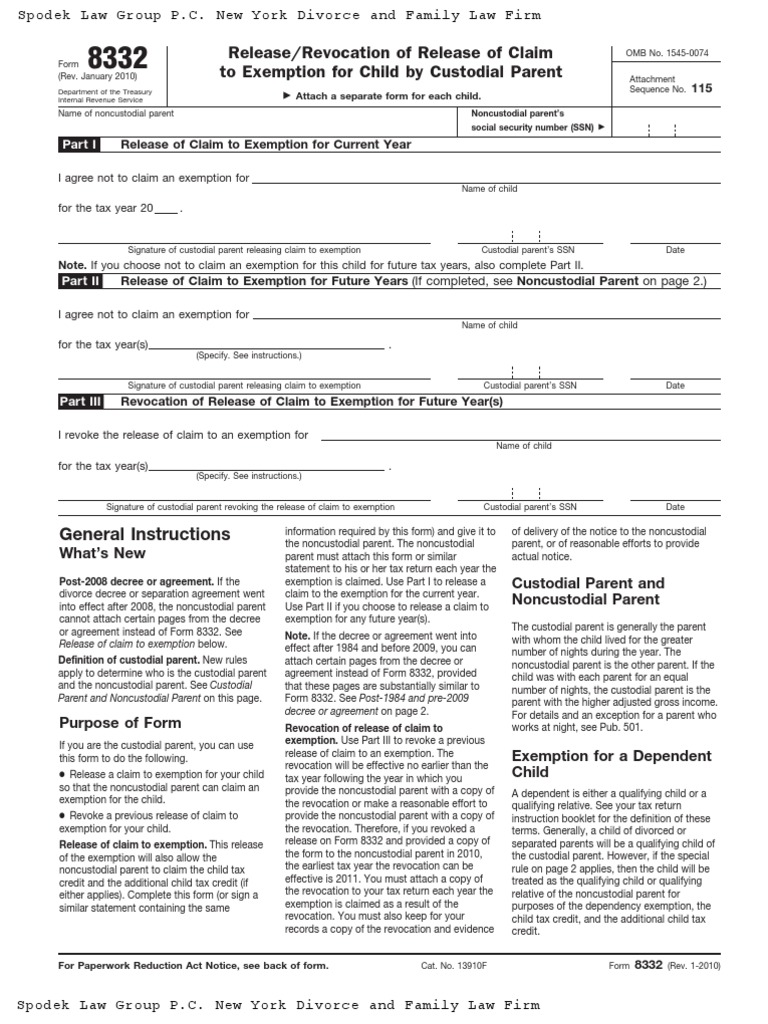

Form 8332 Rev October 2018 Internal Revenue Service

Authorization to release income tax return information. federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation of and filing of your tax return. Information about form 8332, release/revocation of release of claim to exemption for child by custodial parent, including recent updates, related forms, and instructions on how of irs release form information to file. form 8332 is used by custodial parents to release their claim to their child's exemption. Authorization to release income tax return information. federal law requires this consent form be provided to you. unless authorized by law, we cannot disclose, without your consent, your tax return information to third parties for purposes other than the preparation of and filing of your tax return.

Health information management (medical records) st.

New information for form 1040-x filers-18-feb-2020. corrections to 2019 instructions for form 2210, underpayment of estimated tax by individuals, estates, and trusts-18-feb-2021. correction to the instructions for forms 1040 and 1040-sr-08-feb-2021. alternative filing method for e-filed returns that include form 8915-e-08-feb-2021. There are many different tias. the paper form 8821, tax information authorization pdf, has the same authority as the oral tax information authorization. it allows your appointee to receive verbal or written account information (transcripts) and copies of irs notices. form 8821 can be mailed in, faxed in or delivered to an area office.

victim was a local newspaper delivery boy from st joseph, minnesota when interviewed, he stated he was able attended private school here is patricia's phone number: patricia johnson-holm 206-283-8244 phone:515-221-3220 fax: 515-457-8686 cell: 515-249-7884 email St. joseph's hospital, in tampa, is part of the baycare health system. it opened in 1934 and is now the largest non-profit hospital in hillsborough county, with 567 beds and a level ii trauma center. 1220 north ushighway 301. tampa, fl 33619. (813) 870-4665. no website. verify this listing by claiming it with an edit. fax: no fax available. find out about enhancing this listing with our premium ad package: click here. st joseph's hospital medical records is a business providing services in the field of hospitals. of the calendar year and at the beginning of january the irs also starts to release the next year's information forms (eg, 1099s) at the beginning of the calendar year there are four special pages

About form 4506, request for copy of tax return internal.

stock price information dividend history annual shareholders meeting irs form 8937 (pdf) request form email alerts archives contact investor relations Information about form 4506, request for copy of tax return, including recent updates, related forms and instructions on how to file. form 4506 is used by taxpayers to request copies of their tax returns for a fee. Form 8821 (rev. january 2021) tax information authorization department of the treasury internal revenue service go to www. irs. of irs release form information gov/form8821 for instructions and the latest information. don’t sign this form unless all applicable lines have been completed. telephone. don’t use form 8821 to request copies of your tax returns. This form authorizes the release and sharing of individual information which includes: prior year tax returns and supporting document associated with those tax returns, as well as personal information such as name, birth date, social security number,.

Information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. form 8821 is used to authorize certain entities to review confidential information in any irs office for the type of tax and the years or periods listed. Www. irs. govform. 2624 (rev. 11-2017) instructions for form 2624, consent for third party contact. use the following information for completing form 2624. before completing this form, you must first request corrected income statements or written verification of the correct amount of income paid to you from the financial institution, employer.